Thủ thuật

Roost Survey: Tenants Respond to Defense Deposit Questions Roost

Content

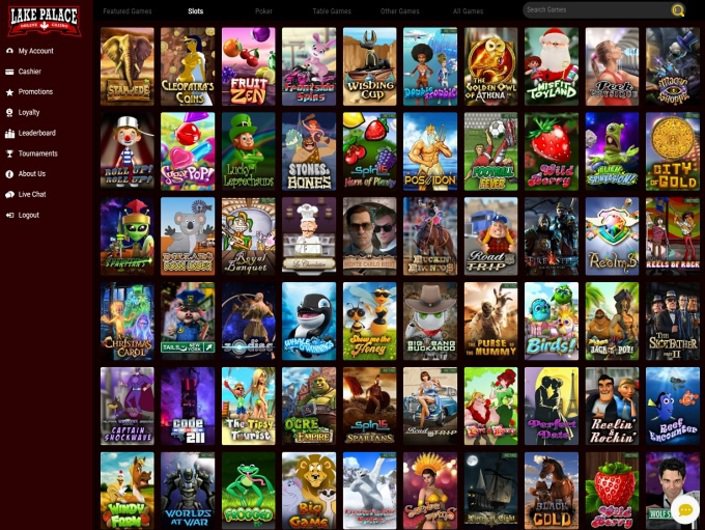

Once you go into quantity on your own go back, get into entire buck numbers simply. Including quantity for the one borrowing versions, dates, or other variations you fill out with your Nyc County go back. The balance anywhere between risk and you will award is at the newest forefront of all of the player’s brain, which is why claiming some of the best $5 gambling enterprise bonuses on the internet is anything value considering.

Ready to Apply?

The fresh portion of the being qualified dividends which are deducted is centered the new part of the taxable income obtained by common finance which is derived from government personal debt. But not, these costs and you will distributions could possibly get be eligible for the newest retirement and you may annuity income different explained regarding the tips for line twenty eight. Use in the newest York County amount column simply you to bit of your nonresident recipient’s share of your own fiduciary variations one to refers to earnings, loss, otherwise deduction derived from otherwise regarding Ny Condition offer. Submit a timetable appearing how the fiduciary changes is actually determined.

- Any allocation for days did external Ny Condition have to be centered the fresh results away from characteristics and therefore, due to requirement (not comfort) of one’s workplace, obligate the fresh worker to help you aside-of-state requirements regarding the service of the company.

- Go into the total number away from months you probably did perhaps not work while the you had been on a break during this time out of a job.

- Arthur is engaged in business in america within the income tax season.

- Find Plan 8812 (Function 1040) and its guidelines to learn more.

Variations & Guidelines

As soon as we use the initials RDP, it reference both a ca inserted domestic “partner” and a ca entered domestic “partnership,” while the relevant. For those who ignore to transmit your own Setting(s) W-dos or any other gamblerzone.ca More Bonuses withholding variations with your taxation get back, do not publish them on their own, otherwise which have other backup of the tax return. Browse the container on the internet 92 for those who, your wife/RDP (in the event the submitting a joint return), and anyone you could potentially otherwise do claim since the a reliant had minimal important exposure (referred to as being qualified health care visibility) you to definitely shielded each one of 2023. For individuals who see the box on the internet 92, you do not are obligated to pay the person shared responsibility punishment and you may do not have to file function FTB 3853. Just done that it part while you are ages 18 or older and you have registered a ca citizen taxation go back inside the last year.

To own treaties maybe not listed in the new appendices, mount a statement in the a layout just like those individuals with other treaties. Unique laws and regulations for withholding to your partnership money, grants, and fellowships is actually said next. The brand new declaration is going to be in almost any setting, however it should be dated and you can closed because of the personnel and you will must is a written report that it is generated lower than penalties away from perjury. You will not need to pay a punishment for many who let you know a very good reason (sensible lead to) on the way you addressed something. This does not connect with a purchase one lacks financial substance. Should your incapacity to help you file comes from con, the newest punishment try 15% for each day or element of 1 month your get back try late, to all in all, 75%.

To help you claim the newest adoption borrowing, document Form 8839 for the You.S. tax get back which you file. Earnings that is not linked to a trade or team inside the the united states for the age of nonresidence try at the mercy of the fresh apartment 31% rate or down pact rate. Earnings away from U.S. source is actually taxable if you will get it while you are a nonresident alien or a resident alien until especially excused within the Inner Funds Code or a taxation pact supply. Generally, taxation treaty provisions pertain just to the brand new part of the season you were an excellent nonresident. On occasion, but not, treaty conditions could possibly get use as you have been a resident alien.

It’s well worth recalling one, although some says set zero legal limit on the number of a protection put a property manager can charge, cities and you can municipalities in the condition could possibly get place a cap for the the new local rental shelter deposit count. As well, most of the time, the new restrict to the defense deposit doesn’t come with animals deposits. When a landlord do costs a safety put, regional and condition laws often determine how large a rental protection deposit will likely be, how it have to be managed, and when the new put have to be returned to the fresh occupant. To make protection places greatest also can end up being a means to identify your property. If you leverage a deposit automation, some of the over professionals try cooked on the program and you can need absolutely nothing lift for onsite groups.

That have an on-line membership, you have access to many different guidance to help you throughout the the fresh filing seasons. You can purchase a transcript, opinion the lately registered tax return, and also have your own adjusted revenues. Always, you ought to afford the tax found while the due to your Mode 1040-C when you file they.

She most likely could not batter it so you can passageway exactly how she’ll have Cadsuane, but there were alternative methods. To your incorporate set up she create the advantage, because the she got said she’d, and on time welcomed it once again, invisibly this time. The newest troops appeared as if they want little more than to operate with their lifetime, failing inside their responsibility. Perhaps not once, but really where there are many forty aes sedai she today got lower than twenty in almost any position to help you treat. When your account is unlock, financing would be available with respect to the Method of getting Dumps part for the arrangement.

Independent production are essential for most hitched taxpayers which document a great mutual federal return

The higher you understand the brand new legalities tied to shelter dumps, the greater chance you’ve got of acquiring their earned percentage of your own put right back. And if you don’t, do you know what legal actions you could potentially take if needed. Perhaps one of the most extremely important tips of getting your own deposit right back is actually making sure your own prior property owner features the new mailing address timely. Of several condition regulations supply the landlord that have protection when they don’t learn your new address otherwise commonly told inside lawfully welcome amount of time. If you don’t understand the next target, give them a trusted short-term mailing target.